Matrix Organizational Structure

President

V.P V.P V.P

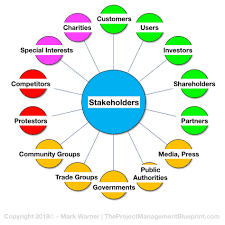

What is Project Stakeholders? its Types, Definition, explanation, all details...

Primary stakeholders:

Example Of Primary or Internal Stakeholder:

Types of primary or internal stakeholder:

Project Manager:

Sponsor:

Project Steering Committee:

Client/Customer:

Project team:

Suppliers/vender:

Project Contractor:

Project Consultant:

Project Champion:

Secondary Stakeholders:

Example Of Secondary or external Stakeholder:

Types of Secondary or external Stakeholder:

Comparator:

Tourists:

The Media :

Families :

Why to manage & engage stakeholders?

Conclusion:

Did you know that we keep bringing you the best articles that have the best impact on your knowledge and your personal life? I am sure you will like our What is Project Stakeholders? article.

If you have any questions about this article, please let us know in the comments. We will provide a better answer. You can visit our website to see more of our great articles.

We hope you enjoy the article and enjoy it.

Thank you.

Project Management Processes (Case Study)

Project Management Processes:

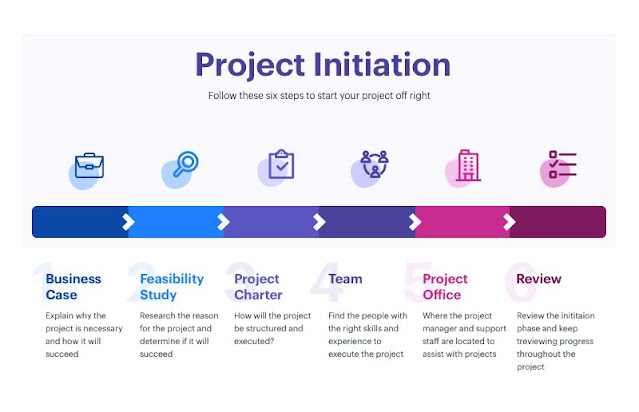

Project Initiation Stage:

I. Project Charted

The document showing what actually is project all about and can be accessed by

anyone.

In this we will answer some question like, why to undergo this project?

What are our expectations from this project? Who will be our target customer? In

this we have to identify that what sources we have to accumulate either these

will be internally or externally.

How funds will be generated. The budget and

duration of the project will also be talked about and will be noted in this

document.

II. Identifying Stakeholders:

At this stage we have to identify our stakeholder

that who are the stakeholders in this project. It is to be define internal stakeholders

like investors (banks in our case), employees, management and connected

stakeholders like customer (govt. or non-govt. organizations in our case),

suppliers, competitors (banks, insurance companies, saving centers etc. in our

case), etc. and also external stakeholders like government, pressure groups

(substitute product producers), etc.

Project Planning Stage:

1. Project Management Plan:

It is consists of series of plans that guide the project manager and its team during the execution and controlling of a project. Project management plan covers the whole theory and guide line of the project.

One of the valuable project management plans includes the project strategies with scope, objective and goals to achieve.

2. Project Management Planning Process:

Execution Stage:

Monitoring and Control:

Final Words:

Did you know that we keep bringing you the best articles that have the best impact on your knowledge and your personal life? I am sure you will like our What is Project Stakeholders? article.

If you have any questions about this article, please let us know in the comments. We will provide a better answer. You can visit our website to see more of our great articles.

We hope you enjoy the article and enjoy it.

Thank you.

Porter's Five Forces Model (case study on UBL Pakistan)

1. Barriers to Entry:

2. Bargaining Power of Supplier:

3. Bargaining Power of Customers:

4. Availability of Substitute Product:

5. Rivalry among the Competitors:

Macro Environment Variables (Case Study of UBL Pakistan)

These are the variables which affect all the firms and all the industries and can occur all across the boundaries. These are the common issues but the individual firm or even the industry does not have capability to stop these factors from occurring.

Different authors used different terminologies to define these factors that are:

• PEST – Political Economic, Social and Technological

• PESTEL – Political, Economic, Social, Technological, Environmental and Legal

• SPENT – Social, Political, Economic, Natural and Technological

• STEEPLE – Social, Technological, Economical, Environmental, Political, Legal and Ethical

1. POLITICAL VARIABLES:

From the start when the Pakistan has taken part in the war against terror, the political, economical, and social environment is changed and all the industries and sectors in Pakistan have been negatively affected.

Many factors like fiscal policies on tax, exchange rates, inflation and government agencies regulating competition, are the major issues contributing to downturn of the UBL revenues.

The deposits with the UBL have been decreased from 25.1% to 19.9%, in last seven years. Looking in contrast, the total operating revenues diminished from 57.0% to 20.3% in recent years. And this is because the drastic changes in the political environment of the country.

2. ECONOMIC FACTORS:

As the economy of the Pakistan has shown downward trends in the recent years & the business activities became sluggish. UBL in this regard having the cash low from investment activities in the country declined from Rs.9,817(m) to Rs.6,530(m). From this it is quite easy to say that economics factors has seriously affected the growth and earning of the UBL. From the financial statement of UBL it is obvious that the operating cost increased from Rs.13,929(m) to Rs.11,664(m) in few years back.

Financial ratios analysis shows that in recent years the Net Profit Margin has been diminished from 31% to 21% and this is mainly because of economic down-turn in the country.

3. SOCIAL CONSTRAINTS:

UBL is also influenced by the social constraints in case of saving and investment habits of the people. Customers first need for investment is surety on safety of investment which the Pakistan’s economy is lacking, the potential investors are saving their money in foreign banks are also investing their capital outsides the country. But, besides to all this banks has fulfilled the social responsibility concept by donating to NGOs and NPOs in the field of education, health, etc.

4. TECHNOLOGICAL FORCES:

As the old technology is becoming obsolete and advanced technology is taking place. Parallel to this, customer’s needs are arising day by day, so to satisfy the customer’s need and remaining in competition UBL is also acquiring new technology. And this replacement leads to lots of money to acquire new technology, which has raised the operating cost of the bank.

Decision Making

Role of Capital Budgeting

To simplify matters, academics and practitioners categorise investment and financing decisions into long-term (strategic) medium (tactical) and short (operational). The latter define working capital management, which represents a firm’s total investment in current assets, (stocks, debtors and cash), irrespective of their financing source. It is supposed to lubricate the wheels of fixed asset investment once it is up and running. Tactics may then change the route. However, capital budgeting proper, by which we mean fixed asset formation , defines the engine that drives the firm forward characterized by three distinguishing features:

Combined with inflation and changing economic conditions, uncertainty complicates any investment decision. We shall therefore defer its effects until Chapter Four having reviewed the basic capital budgeting models in its absence.

With regard to a strategic classification of projects we can identify:

- Diversification defined in terms of new products, services, markets and core technologies which do not compromise long-term profits.

- Improvement designed to produce additional revenue or cost savings from existing operations by investing in new or alternative technology.

- Buy or lease based on long-term profitability in relation to alternative financing schemes.

- Replacement intended to maintain the firm’s existing operating capability intact, without

necessarily applying the test of profitability.

Business Research

We must also collect that information (data) in a fair and systematic way. For example, we should think about who we ask for information, and how they will understand our questions. If we cannot ask everyone involved, then we must be able to justify why we ask only a certain section of that population.

Global Business Environment

Six Sigma Definition

• A Measure: A statistical definition of how far a process deviates from perfection.

• A Target: 3.4 defects per million opportunities.

• A Philosophy: A long term business strategy focused on the reduction of cost through the reduction of

variability in products and processes.

“A comprehensive and flexible system for achieving, sustaining and maximizing business success. Six Sigma is uniquely driven by close understanding of customer needs, disciplined use of facts, data, and statistical analysis, and diligent attention to managing, improving, and reinventing business processes.”